43.6 million people are in student loan debt — and the number continues to rise. In June of 2023, in a 6-3 decision, the Supreme Court denied the Biden administration’s student debt loan forgiveness plan, leaving borrowers, including some of the SF State community, stuck with their debt.

With the high cost of living in San Francisco and the newly-approved 5% tuition increase by the California State University Board of Trustees, SF State students are more than likely to take out student and other types of loans in the upcoming years. Student loans don’t seem to be going away anytime soon. At what cost is it worth it to get a degree anymore if it means taking on the debt?

Higher Education At a Cost

For many students, including SF State alumna Tenaya Tollner-Silva, obtaining a four-year degree was always a goal despite the financials.

“So, my parents — they both also took loans out to go to school, and they were definitely pushing towards me going and getting a four-year degree,” Tollner-Silva said. “It was kind of something I knew I wanted to do as well. The conversation wasn’t ‘Do you want to still do this, even if you have to take loans out?’ It was ‘You’re gonna go to a four-year, but we can’t afford it so you’ll be taking loans out.’”

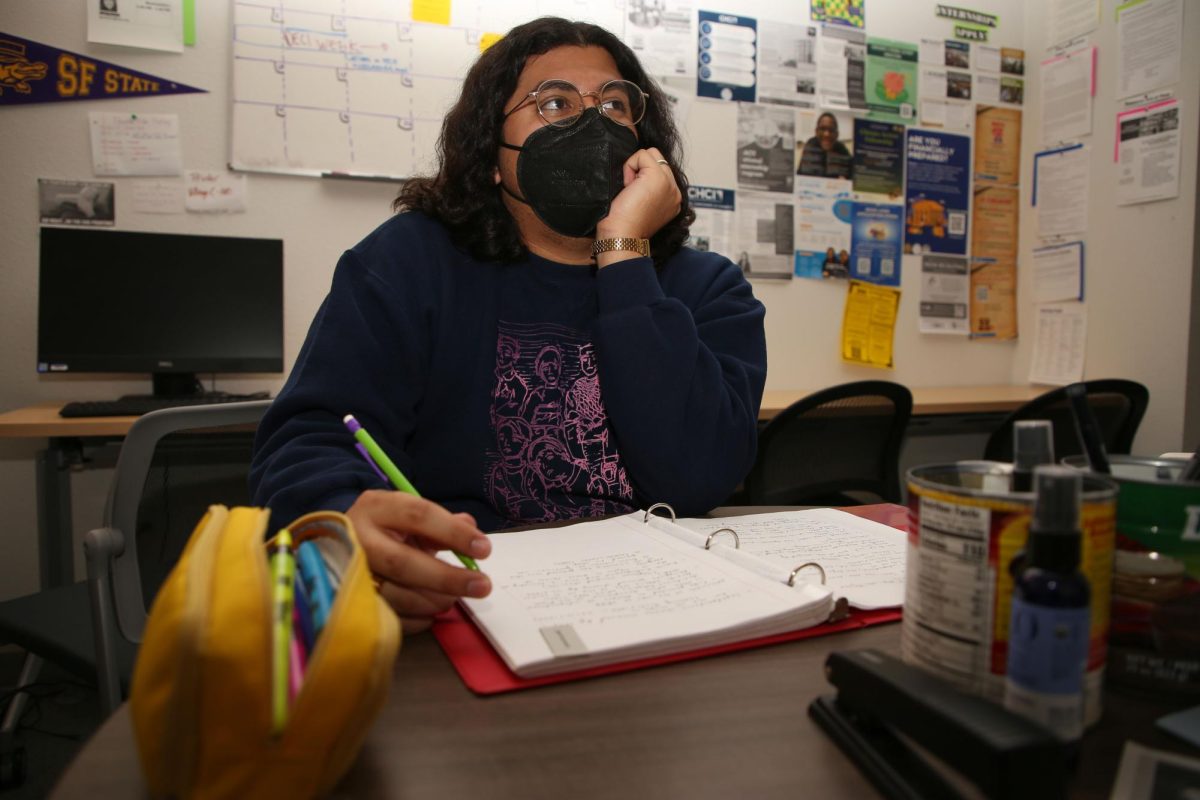

The supposed affordability of a CSU is what brought most students like Jacob Rivas, a broadcast and electronic communication arts major, and Mars Navarro, a studio art major, into getting their degrees.

“I knew that I wanted to go to a Cal State no matter what, because I would get a little bit better financial help,” Rivas said. “’I [thought] I’m definitely going to Cal State because it’s just cheaper than if I were to go to a [University of California campus].”

“The fact that when I applied, tuition was an average of $4,000 — it was what drew me to the school a lot more,” Navarro said.

According to the Education Data Initiative’s study on student loan debt statistics, “The average federal student loan debt balance is $37,718, while the total average balance (including private loan debt) may be as high as $40,499.”

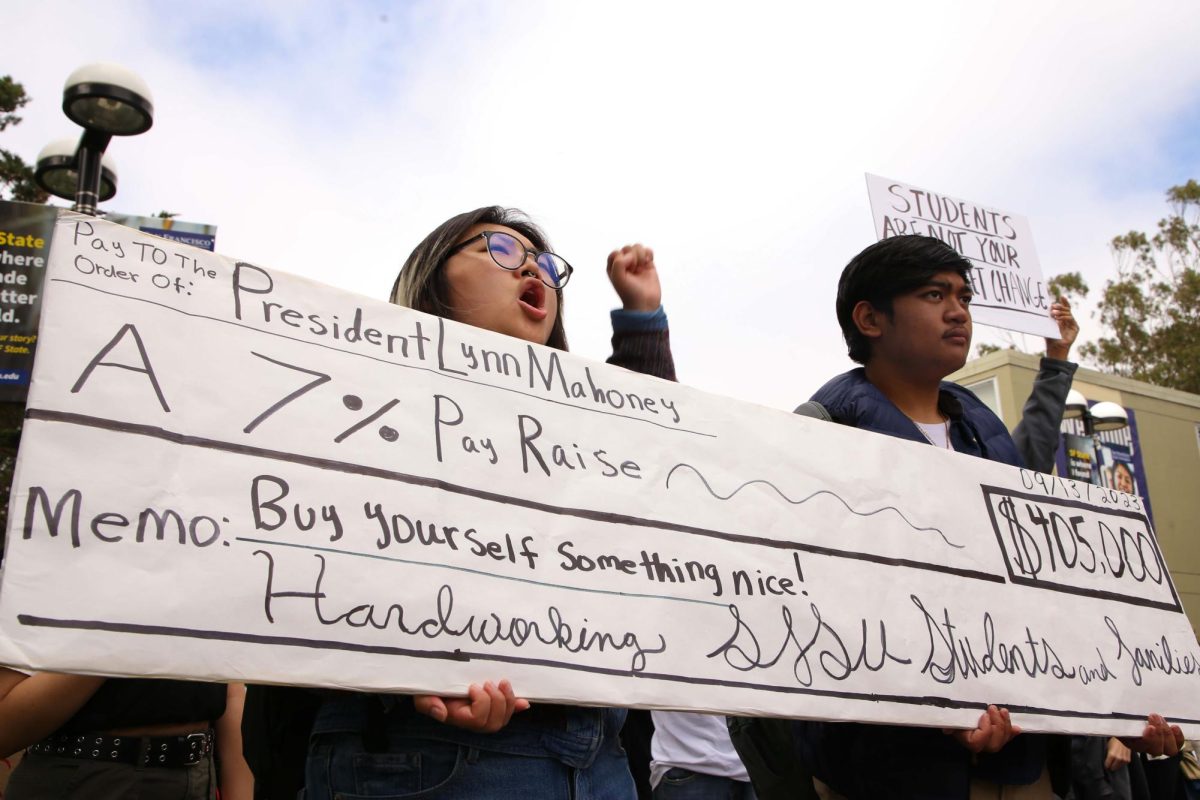

While the tuition fee for seven units or greater is the same whether a student lives on or off campus, starting Fall 2024, the cost will increase by 5% per year for the next five years. The fee increase will affect many students, including Navarro.

“[Hearing about the tuition hike] wasn’t as bad at first, simply because I knew that I wasn’t going to be there [at SF State] for that much longer,” Navarro said. “But […] $500 extra per semester — that’s still a pretty good amount that I could be putting into other, more important, things, like if I’m going to be applying for a graduate program. “Just thinking about that made me realize that wasn’t very fair to students who have to work to support themselves, not just for financial aid students.

Post-graduation Life

Students pursue higher education in hopes of making a living after obtaining their degree. However, loans don’t consider the cost of living in San Francisco post-graduation. Tollner-Silva moved back home to Sacramento after graduating in 2020 because the cost of living in San Francisco was not feasible.

“Eventually, I would love to use my degree,” Tollner-Silva said. “But it’s hard when you have a creative degree. I’ve moved out of the Bay Area just for the sake of being able to afford to live. And when you’re not in a major city, those opportunities are lower and lower.”

The cost of tuition is just a portion of the cost of living in San Francisco for SF State students. With the added burden of student loan debt, Rivas does not see himself staying post-graduation.

“I think I’d probably go back home to [Los Angeles]. Living in SF is already expensive,” Rivas said. “That is my goal in life, literally, because [debt is] honestly kind of a life sentence […] I’m gonna start pushing in a lot of money into the loans and paying it back.”

According to a Pew Research Center study on student loan debt, “College graduates ages 25 to 39 with loans are more likely than graduates without loans to say they are either finding it difficult to get by financially.” Student loan debt can be a lifelong commitment and determine what comes next for their future.

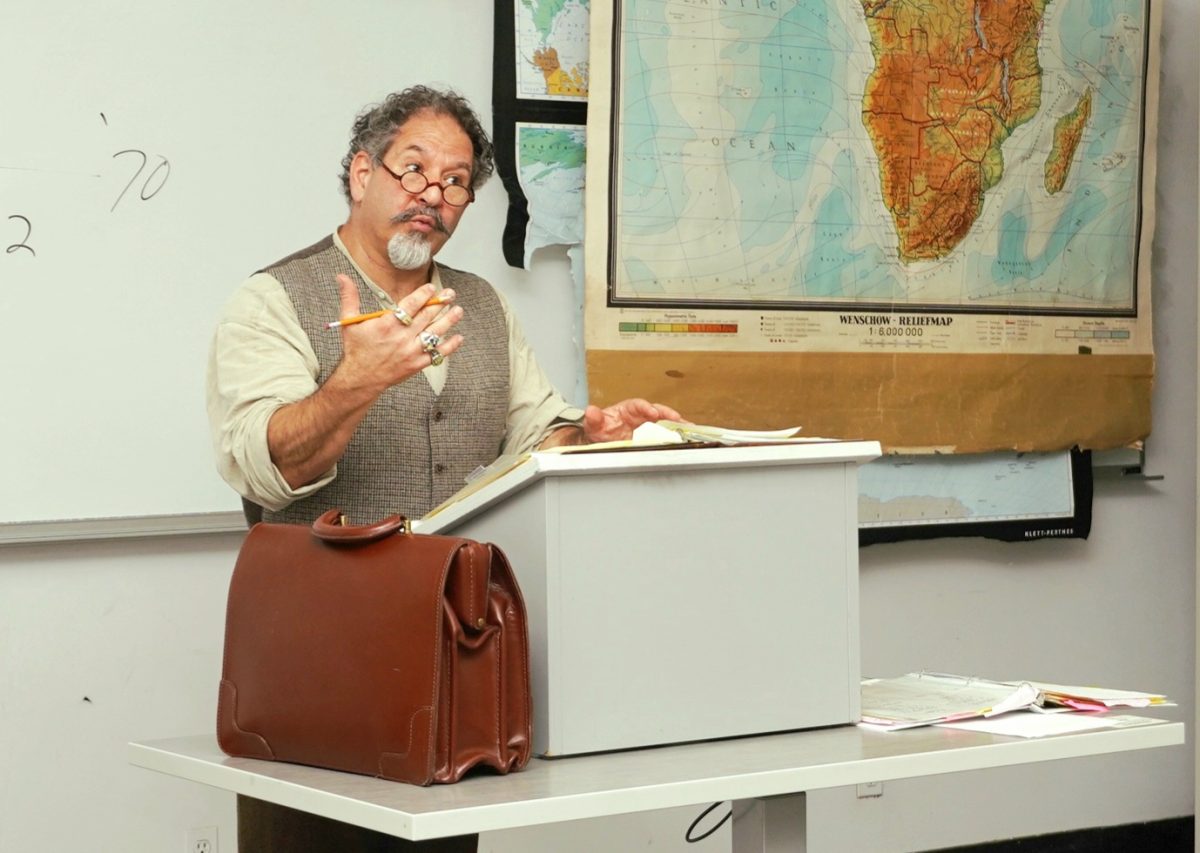

“Student loan debt is going to prevent a whole generation of people from owning homes, from having good credit,” said SF State psychology professor Zena Mello, who specializes in researching socioeconomics. “I think it’s capitalism at its worst, honestly. I think it has really huge impacts on student life.”

“It’s like — okay, you did everything you could to go to college, and now you’re a college graduate,” Mello continued. “And that should get you into the [job] playing field, but it doesn’t, because now you have this debt. So it’s like […] an anchor on your ankle, it’s something else keeping you down.”

However, students can look into refinancing their loans, which can decrease both the principal payment cost and interest fee.

Student Loans Are Common but Taboo

SF State provides resources for the Free Application for Federal Student Aid but does not openly offer in-person courses regarding student loans. In order to receive individual help, students can either walk into the One Stop center in the Student Services Building on campus, or schedule an appointment with the Office of Student Financial Aid online or over the phone.

“[Counselors] always talk about just financial aid, but they don’t really talk about the loans,” said Rivas. “I think that’s a conversation that needs to be had every single time we talk about financial aid. So many people are in debt.”

Most students enter their college years between the ages of 17 and 18. Having to make an important financial decision at that age can mislead students about the realities of taking on debt.

“For someone who’s under the age of 24, there should be a mandatory course that they have to take in order to take out loans,” Tollner-Silva said. “You’re just not focused on the bigger picture, you’re more willing to take risks — potentially [taking] up to hundreds of thousands of dollars depending on the schools they go to and how long they’re in school […] I really felt like I was still a child then.”